There was a time when the measure of corporate success was profits: the difference between the amount of money they spent and the amount of money they took in. This would have been around the same time T-Rex was terrorizing scantily clad Racquel Welch. These days, growth is the measure of corporate success. That's right - if your corporation isn't expanding, you may as well find yourself a job on a checkout counter at a Qwik-E-Mart, because it's only a matter of time before your stock price plummets and your shareholders are out for your oh so very precious blood.

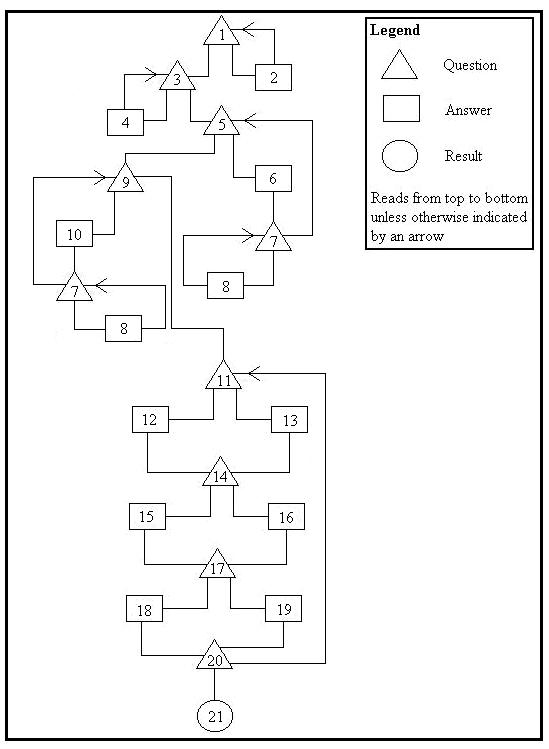

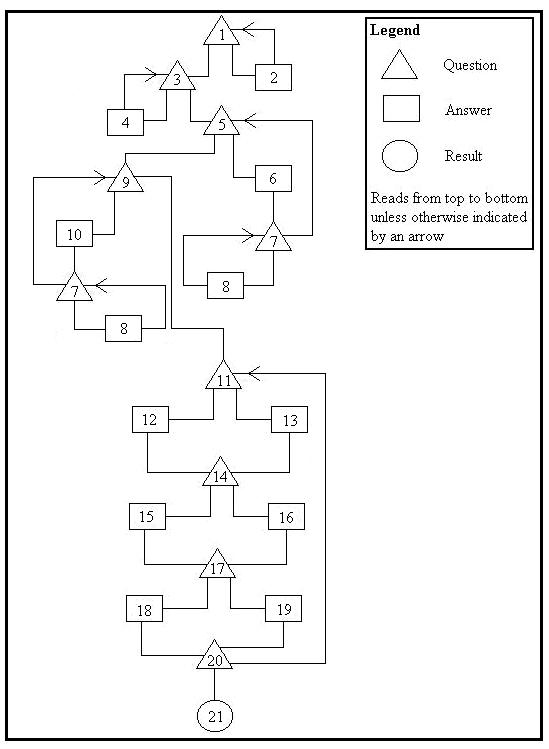

It doesn't have to be this way! There are a number of very simple rules to guide you in growing your corporation. We've put them all together in this easy to follow flow chart - simply follow the questions down until you recognize the condition of your company, then act accordingly!

| 1 | Is the domestic market mature? | |

| NO | 2 | Increase advertising and introduce new product lines. |

| YES | 3 | Is the international market mature? |

| NO | 4 | Increase advertising and introduce new product lines. |

| YES | 5 | Do you have any suppliers who are economically vulnerable? |

| YES | 6 | Buy them out and vertically integrate. |

| 7 | Are shareholders complaining about the company's rising debt due to the cost of the expansion? | |

| YES | 8 | Sell off minor components at bargain basement prices to mollify the shareholders. |

| NO | 9 | Do you have any competitors who are economically vulnerable? |

| YES | 10 | Buy them out and horizontally integrate. |

| 7 | Are shareholders complaining about the company's rising debt due to the cost of the expansion? | |

| YES | 8 | Sell off minor components at bargain basement prices to mollify the shareholders. |

| NO | 11 | Are your managers ruthless enough to do whatever it takes to improve the company's growth? |

| NO | 12 | Tie executive compensation to lucrative stock options in order to lure the best managers to your company. |

| YES | 13 | Tie executive compensation to lucrative stock options in order to keep the best managers at your company. |

| 14 | Does your company have strong unions? | |

| NO | 15 | Demand lower worker wages or you will move production offshore. |

| YES | 16 | Move production offshore to lower wages. |

| 17 | Is your company's growth slowing down, affecting your stock market price? | |

| NO | 18 | Mildly overstate earnings. |

| YES | 19 | Wildly overstate earnings. |

| 20 | Are you being investigated for overstating earnings and/or excessive executive compensation? | |

| YES | 21 | Stonewall, shred key documents and eventually declare bankruptcy. |

Notes

Circumstances vary, but the time between steps 5 and 21 is usually 10 to 15 years. If, by then, your company isn't groaning under the weight of unsupportable debt, you are likely to be a target for takeover yourself. In this case, accept your golden parachute with grace and buy yourself a tropical island to retire to.

As a general rule, stock prices will rise right until step 20, at which point they will fall precipitously. Best to execute your stock options before you are indicted. With the money you make, you will be able to hire the best lawyers, and buy enough business friendly politicians that you likely won't have to spend a day in jail. That tropical island is looking better all the time.

The Corporate Economic Growth Algorithm should not in any way be construed as an endorsement of the activities it describes. The Algorithm describes corporate behaviour based on empirical evidence - what the Globe and Mail's Report on Business says is going on in the corporate sector. It does not attempt to put these behaviours in any sort of moral framework.

Furthermore, not all of the activities described in the Corporate Economic Growth Algorithm are condoned by the Securities and Exchange Commission, or other state, provincial or federal securities regulators. If in doubt, don't let anybody know what you're doing. In fact, it would probably be best for all concerned if, after you have read this document you shred it immediately. Plausible deniability isn't just for politicians any more, and as it happens, even implausible deniability has its uses.